8 Gold Price History Mistakes It is Best to Never Make

페이지 정보

작성자 Vito 작성일 25-01-06 01:50 조회 13 댓글 0본문

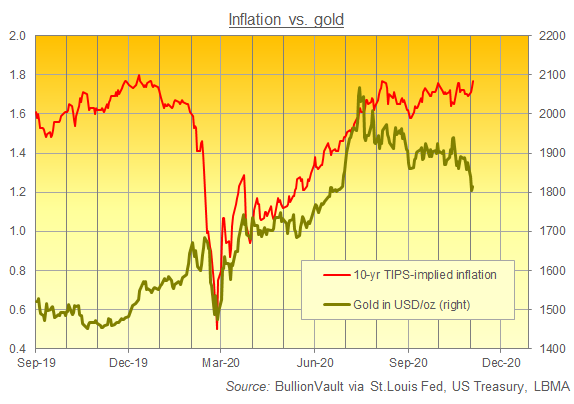

Investor conduct is one other important issue, as global worth traits and market news can influence native demand for gold and subsequently local costs. Essentially the most direct impression happens by way of change rates, the place changes within the worldwide gold worth lead to corresponding changes in the worth of gold in native currencies. 1. Economic Conditions: The state of the global economic system, inflation charges, curiosity rates, and general financial stability all affect gold price prices. In upcoming reports, we'll dive further into the outlook for key variables, together with interest charges, inflation expectations, and ahead vitality costs; nonetheless, on this report, we merely current a two-means sensitivity model to show the asymmetry of value danger from present ranges. So, take a little time to find out about basic bathroom layouts, including plumbing and mechanical concerns that will affect your choices - and their prices. Historically, the next ratio means that silver could also be undervalued compared to gold, making it an opportune time to contemplate silver investments.

Investor conduct is one other important issue, as global worth traits and market news can influence native demand for gold and subsequently local costs. Essentially the most direct impression happens by way of change rates, the place changes within the worldwide gold worth lead to corresponding changes in the worth of gold in native currencies. 1. Economic Conditions: The state of the global economic system, inflation charges, curiosity rates, and general financial stability all affect gold price prices. In upcoming reports, we'll dive further into the outlook for key variables, together with interest charges, inflation expectations, and ahead vitality costs; nonetheless, on this report, we merely current a two-means sensitivity model to show the asymmetry of value danger from present ranges. So, take a little time to find out about basic bathroom layouts, including plumbing and mechanical concerns that will affect your choices - and their prices. Historically, the next ratio means that silver could also be undervalued compared to gold, making it an opportune time to contemplate silver investments.

In distinction to gold, however, that marked solely the 5th time previously 15 years that skilled analysts as a bunch weren't bullish sufficient on silver. However, it is essential to consider the broader economic and geopolitical context before making investment selections solely based on historic value highs. Real-time transparency is offered, guaranteeing that investors have entry to accurate and up-to-date spot prices, facilitating well-informed trading and investment selections. Later, in September of 2020, the gold to silver ratio dropped to 70. Trading this ratio again would permit the investor to commerce his 560 ounces of silver for 8 ounces of gold. For instance, let’s say an investor purchased 5 ounces of gold in January 2019 when the gold to silver ratio was 82. That investor who was trading the ratio could have seen a chance to trade his gold for silver in April or May of 2020 at a ratio of 112. That would give the investor 560 ounces of silver. On this case, one of many board members of the Federal Reserve made remarks to the general public that indicated price cuts could also be imminent in 2024. The potential of decrease interest rates makes gold enticing because it serves as a hedge towards inflation and provides a lower alternative value when yields on other investments decrease.

From 1980 to 1984, regardless of a 6.5% inflation fee, gold prices fell by 10% annually, revealing its inconsistent nature. It has reached new all-time highs multiple occasions as traders anticipated fee cuts amidst robust financial elements and steady progression towards the FOMC’s aim of seeing inflation at 2%. A new ceiling was established on September 26th, 2024, when gold reached $2,685, one week after the FOMC announced a 50 foundation factors lower to the federal funds charge. This bull run continued until May 20, 2024, when spot gold peaked at $2,450 per troy ounce as traders reacted to the dying of Iran's President, who perished in a helicopter accident during a interval of heightened tensions within the Middle East. Finally, on October thirtieth, 2024, the price of gold reached $2,790 amidst uncertainty surrounding the following week’s U.S. Todd Knoop, a professor of economics and business at Cornell College in Mount Vernon, Iowa, "But in actuality, it was attributable to the same components that have brought on monetary crises all through historical past, in the U.S. and elsewhere: debt-financed speculation. In different words, when folks discover it too straightforward to borrow other folks's money to speculate on dangerous ventures-stocks, bonds, subprime housing, and many others. - then folks threat a lot, and costs boom only to eventually bust." Decades later, unfortunately, we're nonetheless vulnerable to that psychological flaw.

Its release was the culmination of years of in-home negotiations that had seen Ford lose the initiative in Australia to GM in 1945 and forced it to play catch-up for the subsequent four decades. Defined contribution plans have educated the general public for years that a mixture of bonds and stocks offers diversification. This residence laptop was on the marketplace for an astonishing sixteen years. Events, news, and market sentiment can result in rapid price swings. The arbitrage alternatives that come up between gold futures and spot markets result in the convergence of costs, as traders capitalize on price disparities. When gold approaches or surpasses its historical peak, some investors view it as a sign to contemplate promoting, anticipating a possible correction. It spreads threat by allocating investments throughout different asset lessons, decreasing the potential for catastrophic losses. For now, readers should know that gold is both a secure haven asset and a non-correlated investment class.

If you beloved this posting and you would like to get more facts relating to gold price kindly take a look at our own web-site.

댓글목록 0

등록된 댓글이 없습니다.